“Utility-scale solar has stagnated,” said Keith Downie of recently unstealthed startup Erthos, “and it’s long overdue for a fresh look.”

By “fresh look,” Erthos means getting entirely rid of trackers and racking and installing the photovoltaic solar modules directly on the ground. It’s a radical innovation that challenges a basic architectural tenet of utility-scale solar and the $3 billion business of trackers and racking.

By eliminating “a tremendous amount of unnecessary materials and risks,” Erthos claims it can build a solar power plant in half the time for nearly half the cost on a third of the land, all while using 70 percent less cable and trenching.

Erthos’ design has no steel trackers and requires “only light civil engineering,” and the system can roll across different topographies with little need to grade, according to the company.

“Since you’re not driving piles into the ground, you have no subsurface risk — what’s happening under the array is inconsequential,” said Daniel Flanigan, chief marketing and product officer, in an interview with Canary Media.

Module cost threshold reached Flanigan claims that Erthos anticipated the threshold at which the performance gains of tracking are negated by the low price of solar modules. “You can simply buy more solar modules for the loss of energy you endure for not having a tracker,” he said. “We cross that threshold at module costs of 38 cents per watt.”

Since it eliminates geotechnical concerns, says Flanigan, “It’s simpler to install than any system out there.”

The Erthos projects are not developed in the manner of a typical solar project that employs an engineering, procurement and construction company. Flanigan said the developer is Erthos’ customer in what it calls an “owner-architect” business model with a “more natural alignment” between developers, builders and operations and maintenance (O&M) providers.

Erthos provides a development platform, acts as the solar architect for the developer and project engineer, and provides O&M services. The company has raised $7.4 million in funding; Jim Tyler (former VP of engineering, procurement and construction at First Solar) is at the helm as CEO.

Erthos partners with Directional Services, an installer of utility-scale solar, and has a licensing agreement with solar module manufacturers ET Solar, ZNShine Solar and HT-SAAE. Erthos focuses on projects in the range of 20 megawatts to 100 megawatts.

Commodity costs increase, utility-scale solar stalls The 82% reduction in solar cost over the last decade stemmed from economies of scale, better technology and supply chain improvements, according to the International Renewable Energy Agency.

But it’s going to be very difficult for the declines in solar plant costs to maintain that pace. This plot of the utility-scale solar cost stack from the U.S. National Renewable Energy Laboratory lends some credence to the claim that utility-scale cost declines have stagnated. At the same time, utility-scale market growth has been anything but stagnant. The U.S. hit 50 gigawatts of cumulative operating utility solar in 2020 and is on track to reach 100 gigawatts by the end of 2023, according to research firm Wood Mackenzie.

Even silicon module pricing might be nearing the bottom of the cost curve: “The era of ever-declining solar module prices is largely behind us,” according to Yan Zhuang, president of Canadian Solar’s manufacturing operation, as reported in pv magazine.

Global commodities such as steel, aluminum and glass have come to play a more dominant role in the solar module bill of materials.

Tracker company Array Technologies had to withdraw its financial guidance for 2021 because of “unprecedented” increases in steel and shipping costs, as reported by PV Tech: “Spot prices of hot-rolled coil steel used in tracker products more than doubled and have continued to increase since, rising a further 10 percent since April 1, 2021.”

“We see our technology as a mitigator of risk around the cost of steel,” said Erthos’ Flanigan.

“That would be an insane approach”

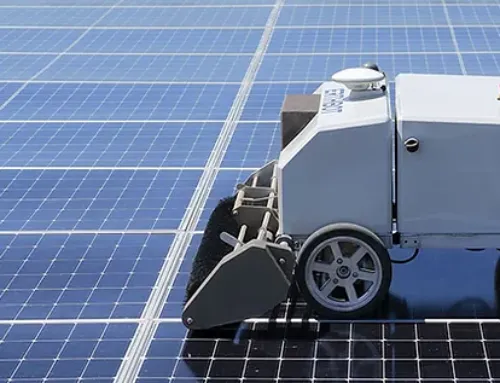

When we asked a solar module reliability expert to assess this earth-mount approach, the questions were about what you’d expect: How do you manage vegetation? How do you inspect and service modules in the middle of the array?

The expert added, “I’m also concerned about the lack of airflow around the module in this system design. Glass-glass modules provide a good moisture seal, but I suspect the back of the module will have very high humidity with no airflow. Damp-heat testing will be important. Not sure what other organic stuff could grow back there, like fungus or mold or things that get in the J-box,” referring to the junction box that houses the equipment that carries electricity from each panel.

Daniel Flanigan, chief marketing and product officer at Erthos, offered this response: “No developer is going to install an Erthos system without proper diligence and all of these issues…being resolved. Yet we are engaged in over a gigawatt of pipeline.”

He continued: “We have had a test system installed since July 2019. We are completed or in process on testing for heat, hail, vegetation, loading and have a DNV bankability report in hand.”

Flanigan says rooftop arrays typically must withstand higher temperatures than a soil-mounted system “because the earth is actually a heat sink.”

He posed this hypothetical scenario: “Let’s say trackers did not exist. Let’s say you were starting with an earth-mount solar design (including a cleaning robot) and identified a particular set of concerns. In how many cases, or aggregate of cases, would you conclude that your solution is to require all of the following (which represent the attributes of a tracker system)?

- Triple the land requirement

- Triple the trenching

- Triple the cable

- Add moving [parts and] mechanical complexity where there was none previously

- Add an enormous amount of steel

- Require the driving of piles into the ground

“That would be an insane approach. And yet that is how utility-scale solar systems are being installed today. We are here to fix that.”

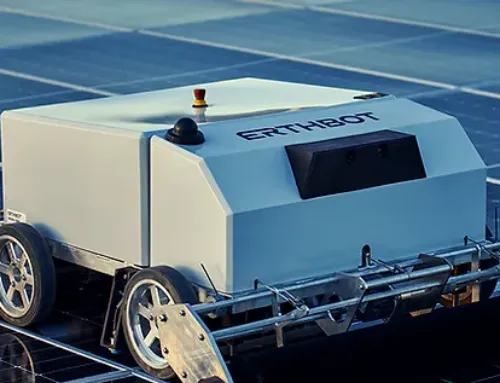

About Erthos

Founded in 2019 and located in Tempe, Arizona, Erthos offers a full suite of products and services aimed at helping developers dramatically reduce the levelized cost of energy or “LCOE” on utility-scale solar power plants. Its executives and management hail from companies including Tesla, Intel, General Electric, SunPower Corporation, First Solar, Depcom Power, Sterling & Wilson, SMA, Solar Frontier, and Plug Power. The team has extensive experience with new product introductions and global markets, including the US, Latin America, Australia, Europe, the Middle East, Africa, India, Asia, and the Pacific. Find out more about Erthos at www.erthos.com.