Despite a pandemic, an import tariff and some of the world’s highest utility-scale solar costs, 2020 was the best year ever for big solar in the U.S.

This year will be even better. The U.S. installed a record 3.6 gigawatts of utility-scale solar in Q1 and is forecast to hit nearly 18 gigawatts this year, according to research from consultancy Wood Mackenzie and the Solar Energy Industries Association.

Utility-scale solar will account for the overwhelming majority of the 160 gigawatts of solar capacity slated to be installed from 2021 to 2026, according to WoodMac’s latest forecast.

A push for American-made solar

U.S. Senator Jon Ossoff of Georgia (D) just introduced the Solar Energy Manufacturing for America Act to promote domestic solar production and narrow the gap between U.S. manufacturers and global competitors.

Right now, Chinese companies dominate solar and own more than 60 percent of global capacity across every layer of the supply chain, according to Bloomberg.

Ossoff’s legislation would create a tax credit for domestic solar manufacturers. It could be inserted into a clean energy plan contained in an infrastructure bill later this year.

American manufacturers at every layer of the solar module supply chain, from polysilicon to solar cells to assembled solar modules, would be eligible for the tax credit.

This adds up to a potential tax credit of 11 to 18 cents per watt for a hypothetical solar module manufactured in a U.S.-based, vertically integrated plant. The generous incentive would be in place through 2028 and then phase down over the following two years.

Ossoff’s bill “would immediately enable long-term, scaled investment in domestic solar manufacturing. I can’t overstate how visionary and ambitious it is,” said Scott Moskowitz, director of market intelligence and public affairs at Hanwha Q Cells. That company’s panel plant in Dalton, Georgia is the largest solar manufacturing facility in the Western Hemisphere and stands to gain at least a 7-cent-per-watt tax credit if the bill passes.

This is astute industrial policy, better very late than never.

First Solar, the largest solar manufacturer in the United States, is spending nearly $700 million to expand its manufacturing operations in Ohio by 3 gigawatts, “giving the Biden administration a concrete win in its bid to have more clean energy equipment produced in the U.S.,” as Emma Foehringer Merchant reported for Canary Media.

Utility solar cost reductions are slowing

The 82 percent reduction in solar costs from 2010 to 2019 stemmed from economies of scale, better technology and supply-chain improvements, according to the International Renewable Energy Agency.

But we can’t expect solar plant costs to continue declining at that pace. As shown in the following chart from the U.S. National Renewable Energy Laboratory, cost declines have flattened in recent years.

Still, companies are seeking to innovate and drive down costs.

Solar grounded?

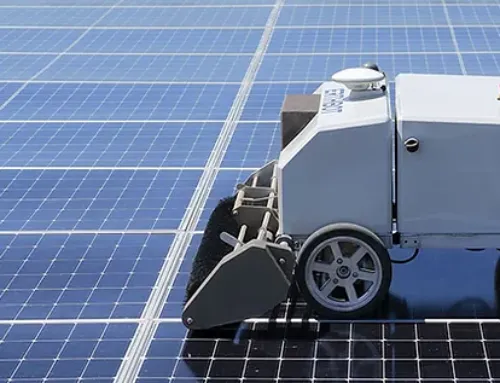

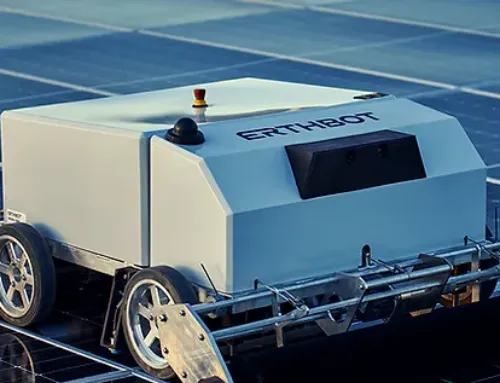

Startup Erthos is installing large-scale solar directly on the ground, dispensing with racking and trackers altogether. It’s a radical innovation that challenges a basic architectural tenet of utility-scale solar and the $3 billion business of trackers and racking.

By eliminating “a tremendous amount of unnecessary materials and risks,” Erthos can build a solar power plant in half the time for nearly half the cost on a third of the land, all while using 70 percent less cable and trenching, according to the company.

“We see our technology as a mitigator of risk around the cost of steel,” said Erthos’ Daniel Flanigan.

A solar module reliability expert raised a number of questions about how such systems would work: How would you manage vegetation? Cope with humidity? Watch for mold? Service panels in the middle of the array?

Solar market headwinds

While solar market growth and falling solar costs are almost taken for granted, the industry is confronting headwinds as solar becomes the leading contributor of new electric generation in the U.S. These include:

Commodity prices: Utility-scale solar is sensitive to hardware price increases — and increasingly vulnerable to fluctuating commodity prices. Solar plants require steel, polysilicon, aluminum, copper and glass as manufacturing inputs. Tracker company Array Technologies had to withdraw its financial guidance for 2021 because of “unprecedented” increases in steel and shipping costs, as reported by PV Tech.

Import tariffs: Since 2018, tariffs imposed by the Trump administration and maintained by Biden have raised the prices of imported solar panels by roughly 20 percent. This could be considered a module tax paid by American solar customers.Investment Tax Credit: The U.S. solar market’s growth historically has been driven by the federal Investment Tax Credit, which now effectively trims residential and commercial solar costs by 26 percent. After 2023, the tax credit will be eliminated for residential installations and drop down to 10 percent for commercial installations. A coalition of more than 100 organizations representing a wide range of clean energy industries has urged the Biden administration to enact a 10-year extension of the ITC at the full rate, including a direct-pay option, as part of the American Jobs Plan, Biden’s infrastructure proposal. A direct-pay component of the ITC could make project financing less reliant on tax equity, a financial class that experienced setbacks due to the pandemic. A long-term extension of the ITC would provide the certainty that energy investors crave.

Lack of solar panel recycling: The solar industry cannot claim to be a clean energy source if it leaves a trail of hazardous waste in its wake. But absent an effective PV recycling policy, the U.S. will send millions of solar modules and tons of toxic materials to landfills in the coming years. Solar panels have finite lifespans, are difficult and expensive to recycle, and are being decommissioned in growing numbers. There’s a looming stream of used solar panels from systems that have been upgraded and repowered; some of the panels have not lived out their full 30-year lifespans. Only one U.S. solar manufacturer, First Solar, has developed in-house recycling capabilities, currently limited to processing the company’s own thin-film cadmium telluride panels. Little to nothing has been done at the U.S. federal and state levels to offer subsidies and establish solar panel recycling systems.

Texas sun

Texas led all other states by a Texas mile with 1.5 gigawatts of new solar capacity in the first quarter of 2021.

Texas is perfect for big solar. Although the state has no renewable portfolio standard, it does have Texas sun, lots of land and a deregulated and competitive energy-only marketplace. There’s also a developer-friendly permitting and interconnection process.

Texas solar is expected to grow to 14.5 gigawatts over the next five years — second only to California in PV generation, according to research firm Wood Mackenzie.

Last year, George Hershman, president of the engineering, procurement and construction firm Swinerton Renewable Energy, told this reporter, “Our biggest market will be in West Texas in the Permian Basin.”

Biden: “Secretary Granholm doesn’t mess around”

U.S. Energy Secretary Jennifer Granholm toured the Townsite Solar Facility in Boulder City, Nevada last week to install some solar panels and promote the potential of clean energy jobs.

Arevon is developing the 232-megawatt solar PV plant south of Las Vegas with Rosendin’s Renewable Energy Group, which provides renewable energy design, planning, construction and maintenance.

Sukut Construction is building the project and completing the civil, channel, piles and racking work. This includes grading and site prep of a 1,053-acre site, 950,000 square feet of access roads, 2 linear miles of soil cement-treated channels, 84,800 driven piles and 6,300 rows of Nextracker single-axis trackers, according to Sukut’s website and other sources.

The project incorporates 528,084 First Solar Series 6 solar modules and uses Sungrow inverters. Townsite will be co-located with a 90-megawatt/360-megawatt-hour energy storage system.

About Erthos

Founded in 2019 and located in Tempe, Arizona, Erthos offers a full suite of products and services aimed at helping developers dramatically reduce the levelized cost of energy or “LCOE” on utility-scale solar power plants. Its executives and management hail from companies including Tesla, Intel, General Electric, SunPower Corporation, First Solar, Depcom Power, Sterling & Wilson, SMA, Solar Frontier, and Plug Power. The team has extensive experience with new product introductions and global markets, including the US, Latin America, Australia, Europe, the Middle East, Africa, India, Asia, and the Pacific. Find out more about Erthos at www.erthos.com.