Rising efficiencies and the plummeting cost of solar modules over the past few years, recent months notwithstanding, are leading innovators toward ideas that may look unusual in the current tracker-dominated world of large-scale solar parks. Advocates of the new approaches argue that they leave traditional models looking decidedly flat by comparison.

The ever-falling prices of solar modules over the past few decades experienced a blip in early 2021. Recent price rises look to be an anomaly of pandemic-related supply chain issues. These issues have spared few in our globalised world, as shipping costs have exploded. The Harpex Index, published by shipbrokers Harper Petersen, tracks worldwide price developments on the charter market for different types of container ships. It shows an almost exponential rise in shipping costs, with the index rising by a factor of 8.6 between May 2020 and August 2021.

A similar tracker, the Xeneta Shipping Index, showed a more than US$6,000 rise in shipping costs per container since the end of April for the Asia-to-Europe route – the obvious way to move solar modules to the European market. The increases in materials and shipping costs have naturally seen solar modules rise in price for the first time in many years, after a decade in which costs have fallen by around 90%.

EU spot prices tracked by pvXchange had their first fall in July, after rising all year. Since the start of 2021, increases have tracked between 6% and 12%, depending on module technology, with bifacial modules seeing the largest jump, at 11.8%.

Module price increases are unavoidable for solar plant developers – projects quite simply can’t exist without them. Therefore, in pursuit of savings elsewhere in system procurement, industry innovators are looking at rising prices of steel as a key risk for bankability. Cormac Gilligan, an associate director at IHS Markit, explains that for tracker makers, this is a material concern. “Global steel prices increased two times to three times between Q3 2020 and Q2 2021, with steel in the United States experiencing the most significant gains,” Gilligan tells pv magazine. “As solar trackers consist of 95% steel by mass, relating to approximately 50% of overall tracker costs, such price volatility represents a significant risk to both tracker manufacturers and PV developers looking to reduce levelised cost of electricity (LCOE).”

Grounded approach

With changing cost structures come new ideas. U.S.-based startup Erthos, at first glance, looks like the opposite of innovation. The Erthos approach is to place solar modules flat on the ground: no tilt, no motorised tracking, no pitch distance calculations. Just a lot of panels, fixed together, flat. The radically simplified process eliminates a range of costs: Erthos quotes a greater than 20% reduction in LCOE, along with faster installation, and less land usage.

To prove the model, Erthos built its first 200 kWac project near Bakersfield, California, making use of ZNshine modules. Three further C&I projects are in pre-construction totalling 1.5 MWac, with each set to be completed by the end of 2021. Jim Tyler, CEO of Erthos, explained the concept, early signs of success, and driving the need for Erthos-style innovations to utility-scale solar – starting with why no one had done this before.

“The simple answer is that the cost of the panel was too high relative to everything else. You needed to point the panel at the sun in order to extract the maximum energy out of it, because that panel cost was too high. That’s the historical, engineering, fundamental reason,” says Tyler, an energetic executive, previously VP of engineering, procurement and construction with First Solar, before leaving to helm Erthos alongside a team of experienced executives.

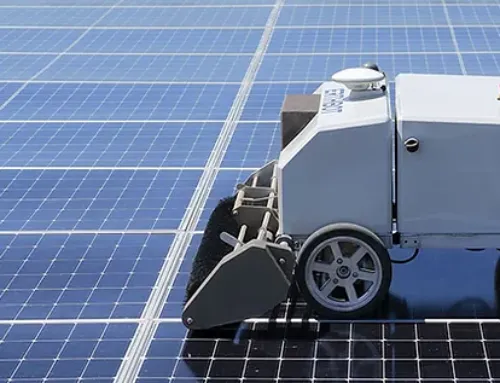

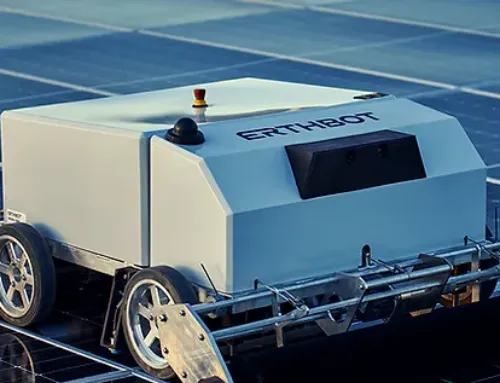

The “ErthCompatible” specification that is licensed by Erthos requires the use of IP68 glass-glass modules. Module suppliers have mostly used bifacial modules to fit that requirement. Another feature of the specification is using aircraft cable threaded through the sides of the module, to prevent movement both up and down or side to side. Keeping the panels secure and flat allows the utilisation of another innovation of Erthos: an autonomous cleaning robot. The robot, or fleet of robots, runs nightly, and a single robot can clean up to 2 MW every day.

Tyler describes the system as an “industrial Roomba,” with extra features, including a thermal camera to analyse module and cell health. Erthos was funded through an initial US$700,000 investment in a family and friends round, before receiving Series A funding of US$7.4 million in August 2020. A large proportion of the Series A was provided by “the largest electrical sub-contractor [in the U.S].” Daniel Flanigan, chief marketing and product officer at Erthos – and previously a co-founder of Zep Solar, which was acquired by SolarCity – notes that the company has a project pipeline of more than 2 GW.

Dirt threshold

Tyler, brimming with assured confidence, explains the processes involved in taking the leap to the dirt, which starts with an assumption.

“The question I asked when I started the company was: If the panel were free, what plant would you design? When that’s the case, the answer is obvious: You’d put them flat on the ground,” states Tyler, the final words a motto he emphasises more than once.

“At that zero-cost principle, I worked my way back up: At what price does it tip back to a single-axis tracker bifacial module? The answer to that, depending on your latitude, is between 38 and 42 cents per watt. If you’re honest with yourself, and you run the real numbers, which is what I did, you come to that same conclusion.”

Tyler’s run of the numbers in May 2019, when the business was started, showed the price of panels was at US$0.32-0.33/W. Even with the recent rise in module prices, panel costs are now below US$0.30/W in the U.S. marketplace. At that price, it’s still more efficient just to add more modules to make up for losses without tracking.

Industry skepticism

Erthos knows the questions that are being asked by the industry. pv magazine spoke to experts about the concept, who offered similar questions and themes. Nicolas Chouleur, partner at Everoze, had concerns over environmental impact, soiling, and maintenance. IHS Markit’s Cormac Gilligan says the same, with “concerns around weather impacts such as hail, snow or areas prone to flooding, land availability constraints such as preference for flat land and other considerations such as vegetation mitigation.” Another experienced solar consultant focused on bird soiling, especially with flat panels, and points out that such soiling could be very difficult to remove.

Erthos has an abundance of answers. “The number of questions we’re fielding is just crazy, and everybody asks exactly the same questions every time. What about water? What about wind? What about erosion? All those questions. That’s the reason it wasn’t done before.” On soiling, Tyler says: “The rough cost to clean a tracker plant, one time, is about 50 cents per kW. We clean our solar plant every day for a year for 50 cents per kW.” Tyler explains his one concern: temperature, a thought that easily comes to mind, given that he resides in Phoenix, Arizona.

“I did a fatal flaw analysis on the idea. The only fatal flaw of concern that I had personally was temperature. And so once I proved the temperature performance of max cell temperature of the module, I was satisfied. I happened to live in Phoenix which is one of the highest temperature places on the planet. And it happened to get to 118 degrees (47.8 C) outside when I was running our first plant in 2019. And sure enough, the module cell temperatures don’t even approach maximum cell temperature. And I said: That’s the answer.

“We are now in exclusivity on a 150 MWac project [in the U.S.], and that project is the lowest PPA that we’ve ever seen. The developer would literally lose money if he sold the plan. With Erthos, we’ve been able to get that project right side up. Ultimately, the uptake of technology such as Erthos will depend primarily on its technical capabilities being confirmed, along with overall project costs and energy yields resulting in favourable LCOE’s compared to tracker or fixed tilt mounted PV projects.”

High density

Other companies have taken less radical, though still novel, approaches to utility solar. While Belectric’s well-known PEG substructure system, now owned by Jurchen Technology, has a high-density solar approach, and the backing of one of the world’s larger solar players, startup 5B has taken a portable approach to a similar east-west, densely packed, fixed-tilt design.

5B, an Australian company, was a winner of the 2020 pv magazine Award, impressing jurors with its prewired, prefabricated and portable solar-in-a-box approach that it calls the Maverick. Its largest installation, dubbed “the world’s largest portable solar array,” consisted of 30,000 modules installed for a 12.8 MW system for South Australian utility SA Water.

After seven years of development and growth in the Australian market, 5B now reports it has global opportunities in Chile, and the United States, and growing interest. Chris McGrath, CEO of 5B, said during the Awards that 5B saw making solar cheaper as the “critical frontier … we’re really picking up off decades of work that’s been done in the module and PV space, making solar modules themselves so low cost, and driving that to new frontiers.”

Another fixed-tilt and portable innovator is Smartvolt, which developed a unique mounting system coupled with a special crane beam. The package facilitates both speedy deployment and dismantling of ground- or roof-mounted PV systems. This has created opportunities for Smartvolt’s system on mixed-use land. A creative application was alongside wind turbines: utilising the crane parking area of a wind turbine, which must be free for use, but outside of unexpected maintenance, is accessed by necessity once every 20 years. Westfalen Wind, a German wind specialist, added 96.8 kW of PV generation to compliment a pilot turbine. Andreas Fankhauser, owner of the Swiss company, explains that the pre-assembly means the company “can install 100 kW in 6.5 hours, and remove 100 kW in 6.5 hours.”

Combined effort

Asked about Erthos’ place alongside 5B, Jurchen Technology’s PEG system, Smartvolt, and others, Tyler says: “I’m rooting for those companies, just like I’m sure they’re rooting for us, right? The concept of high-density solar has arrived because the cost of the panel has gotten so low, and steel so high. We just took it to the final stage, which is to put the thing on the ground.”

About Erthos

Founded in 2019 and located in Tempe, Arizona, Erthos offers a full suite of products and services aimed at helping developers dramatically reduce the levelized cost of energy or “LCOE” on utility-scale solar power plants. Its executives and management hail from companies including Tesla, Intel, General Electric, SunPower Corporation, First Solar, Depcom Power, Sterling & Wilson, SMA, Solar Frontier, and Plug Power. The team has extensive experience with new product introductions and global markets, including the US, Latin America, Australia, Europe, the Middle East, Africa, India, Asia, and the Pacific. Find out more about Erthos at www.erthos.com.